Miami Tax Evasion Attorney

The act of tax evasion is always complex. Unfortunately, making a mistake — even a seemingly small one — can lead to federal charges and the need to hire a Miami tax evasion lawyer. Sometimes it is as simple as relying on the advice of an accountant who is cutting corners and not advising their clients properly.

Tax laws can be very complex. So if you are facing tax evasion charges in Florida, you may need help figuring out what to do.

You are looking at prison time, probation, and hefty fines if convicted. Your assets, even your home, can be frozen and taken from you by the government.

With so much at stake, getting the right legal counsel as soon as possible to discuss your case and determine your best course of action is imperative. Contact the Kirlew Law Firm today to speak with Brian Kirlew, Esq., our experienced Miami white-collar attorney right away.

Effective and Aggressive Legal Services for Defendants in Miami

If you are facing criminal charges for tax evasion or are under investigation for tax-related reasons, you need the legal services of a law firm that understands your situation and how to shield you from serious penalties under the law. Tax evasion cases are complicated, but The Kirlew Law Firm, PLLC, is staffed with highly skilled attorneys and an experienced legal team that includes investigators and support staff.

Setting our law firm apart from the competition is our top-rated team that has secured favorable outcomes for clients in thousands of criminal cases.

Our lead attorney, Brian Kirlew, began his career as a Miami-Dade County public defender. His solid track record of protecting the rights of clients earned him the Outstanding Young Lawyer Award in 2012 from the Miami Chapter of the Florida Association of Criminal Defense Lawyers, and he has since earned the distinguished title of Super Lawyer from 2016 to the present in criminal defense.

What is Tax Evasion?

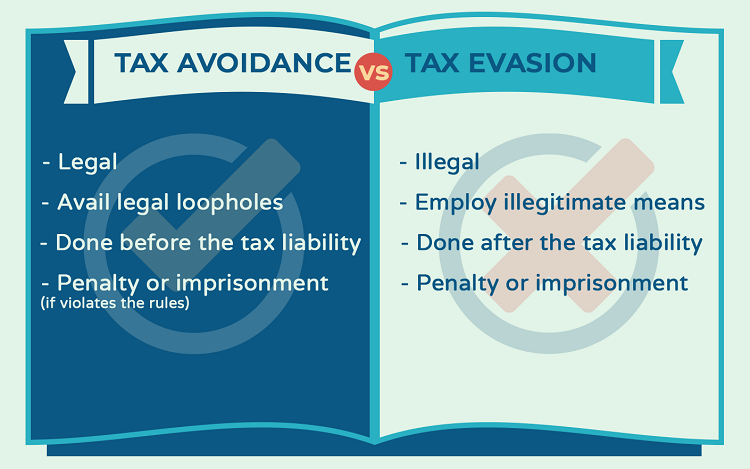

It is worth noting that tax fraud and tax evasion are similar but different charges. While they do overlap, they have specific definitions under federal criminal statutes.

Tax evasion is the act of willfully attempting to evade the assessment or payment of taxes.

This includes underreporting income and overstating deductions and expenses. Tax evasion often goes hand-in-hand with other white-collar crimes such as mortgage fraud, money laundering, and insurance fraud.

Remember that failing to pay does not constitute tax evasion unless done with malicious intent — deliberately misrepresenting your income or deductions to under-report your tax liability.

On the other hand, tax fraud occurs when a person knowingly files fraudulent returns. There are many different ways someone can file false tax returns. However, the most common involves obtaining or trying to obtain a refund by filing an incomplete return or making false claims about your income, exemptions, deductions, or credits.

Penalties for Tax Evasion in South Florida

The Internal Revenue Service (IRS) has various methods of identifying who might be committing tax evasion. When they do find someone who may have been attempting to commit this crime, then they will go through their finances with a fine tooth comb and determine what amount they owe in back taxes plus any penalties for taking so long to report the money.

The penalties for a conviction of tax evasion in federal court depending on the amount of unpaid taxes owed and whether it is a civil or criminal offense. Tax evasion is covered under IRC § 7201. A federal tax evasion conviction can result in a term of imprisonment of up to five years. Additionally, the IRS can add a monetary fine to your tax bill, place a lien on your property or implement a tax levy to seize your income, property, or financial accounts. You can also be barred from operating a business in South Florida and denied government contracts or jobs. Tax evasion, however, is rarely charged by itself. It is usually a part of a larger indictment where a slew of white-collar crimes is alleged. If you receive a letter from the IRS, you need to contact a white-collar defense attorney immediately.

- In Florida state court, being charged with tax evasion at the state level can be punishable as a misdemeanor or felony.

- If the taxes evaded are worth less than $300, then it is considered a first or second-degree misdemeanor and carries a sentence of up to one-year imprisonment and/or up to $1,000 in fines.

- If the taxes evaded are worth less than $20,000 but more than $300, then it is considered a third-degree felony and carries a sentence of up to five years imprisonment and/or up to $5,000 in fines.

- If the taxes evaded are worth less than $100,000 but more than $20,000, then it is considered a second-degree felony and carries a sentence of up to fifteen years imprisonment and/or up to $10,000 in fines.

- If the taxes evaded are more than $100,000, it is considered a first-degree felony and carries a sentence of up to thirty years imprisonment and/or up to $10,000 in fines.

The penalties for tax evasion can be significant, and there is no way to sugarcoat them. If you find yourself facing tax evasion charges, then your best bet is to contact a South Florida white-collar attorney as soon as possible.

Tax Evasion Stats

In Fiscal Year 2024, IRS Criminal Investigation nationwide launched 2,667 tax-related criminal probes, achieving 1,571 convictions and maintaining a 90% conviction rate. These investigations reclaimed over $9.1 billion in tax fraud and financial crime losses.

Tax evasion convictions carry serious penalties, including potential federal prison time, restitution, and long-term financial repercussions. Federal cases like these are prosecuted at the Wilkie D. Ferguson Jr. U.S. Courthouse in Downtown Miami.

In areas such as Coconut Grove, Downtown, and Little Havana, these legal actions underscore heightened scrutiny on those preparing or filing returns.

Defense Strategies for Fighting Tax Evasion Charges

Defending yourself against tax evasion charges requires demonstrating that you did not take actions to knowingly try and defraud the IRS. Making an unintentional tax error is a civil matter, while intentionally falsifying documents or misleading the IRS could lead to criminal charges.

One of the most common defenses is showing that you did not intend to commit a crime or even know that you may have committed one. Prosecutors must prove that you deliberately tried to avoid paying taxes. If the error stemmed from negligence or poor bookkeeping, it may not meet the legal threshold for tax evasion.

Another strategy could involve challenging the accuracy of the government’s financial analysis. Complex tax situations often involve estimates or interpretations that may be wrong or misleading. A skilled defense attorney who understands tax law can show where the IRS may have gotten it wrong.

Miscommunication with a tax preparer is also a potential defense, especially if the accused relied in good faith on professional advice. In such cases, proving reliance on a tax preparer can help undermine allegations of willful fraud.

What to Expect as Your Case Moves Forward

A tax fraud case often begins long before you are officially charged. Federal agents often begin by gathering copies of your records, such as bank statements, tax filings, and transfers, looking for patterns.

You may not know you are being scrutinized until the IRS reaches out with questions or subpoenas. From there, agents begin building a case using financial records, tax filings, and any statements you have made. IRS Criminal Investigation works the financial side, and if they think they have enough evidence to move forward, the Department of Justice takes over.

Once charges are filed, your case is scheduled at a nearby federal courthouse. As with cases at the state level, the pre-trial phase allows the defense to gather evidence and scrutinize the prosecution’s evidence to find weaknesses that could lead to a favorable resolution to the case.

Why You Need Exceptional Legal Representation

Having legal representation during a tax fraud case can greatly improve your chances of securing a favorable outcome in your case. Communicating directly with the IRS could be a costly mistake. Anything you say could complicate your case and make it difficult to defend yourself and your actions later on.

A seasoned tax evasion attorney can independently look into the allegations and evidence used against you. If the IRS misinterpreted information and came to the wrong conclusion, your attorney can set the record straight. In other cases, your lawyer can work to show that you did not act with criminal intent. A simple clerical error or mistake on the part of your tax filer could absolve you of wrongdoing.

Having a representative who communicates with the IRS on your behalf can play a critical role in protecting your rights and securing an outcome that allows you to put the ordeal behind you. In some cases, you may need to only pay for arrears plus interests or penalties. Any step your attorney can take to reduce the criminal element of your case can place you one step closer to a favorable resolution for your circumstances.

FAQs

A: It is common for convicted defendants to potentially face jail time, especially in cases involving offshore accounts or large sums of unpaid taxes. Federal prosecutors may seek prison time even for first-time offenders if the case involves fraud or the intent to deceive.

Defendants can protect their freedom and future by working with an attorney to get their side of the story across. If prosecutors have strong evidence against you, an attorney can take steps to show that you deserve leniency.

A: Yes, it is worth getting a tax lawyer. Tax evasion cases often involve complex audits, financial records, and potential criminal exposure. A tax lawyer can use subpoenas to gather favorable testimony or negotiate with the IRS to resolve the case before it escalates further.

They can also guide their client through the potential outcomes while advising their client to remain silent and not speak publicly about the case. Often, hiring an attorney early can mean the difference between minimal penalties and heading to federal prison.

A: Investigations may take several months or even years. Federal agents typically gather extensive records before making formal contact. Delays are common due to data analysis, subpoenas, and coordination with other agencies. If you suspect you are under investigation, gather your financial records, avoid unnecessary disclosures, and prepare for potential federal inquiries.

A: Tax evasion includes intentionally underreporting income, inflating deductions, hiding assets, or using shell companies to avoid paying what is owed. It requires a willful act, not just a mistake or oversight. The IRS and federal prosecutors look for patterns of deceit or intent to mislead. If you are under scrutiny for tax issues, experienced legal representation is crucial right away.

Act Quickly to Defend Your Rights — Contact the Kirlew Law Firm NOW!

Tax crimes carry serious penalties, and the laws surrounding them can be confusing and nuanced simultaneously. Before you can protect yourself from these charges, it is essential to know exactly what they mean, how you might face them, what your rights are when facing them, and how you might be able to defend yourself against them if you are accused. This is where retaining a skilled Miami white-collar lawyer like Brian Kirlew, Esq. can make all the difference.

Regardless of the nature of the charges, the team at the Kirlew Law Firm will aggressively fight to defend your rights and challenge any wrongful claims that have been made against you. We take pride in our track record for victories achieved by giving clients personal attention and individualized legal representation through all stages of litigation. Call (305) 521-0484 or contact us online to get started on your defense.

Antitrust laws were established to protect trade and commerce from abusive practices. Violations can include price-fixing, price discrimination, restraints, and monopolization.

This form of white-collar crime is increasingly common as more people use computers, phones, and other internet-enabled devices to commit acts of fraud, hacking, extortion, and theft.

Thieves take personal information to access banking and financial accounts, make purchases, open utility accounts, or steal tax refunds. In some cases, an identity thief may even use a false identity during an arrest.

This white-collar crime occurs when a thrift utilizes a stolen credit card or other information from that account to make unauthorized purchases. In some cases, they may use the stolen information to take out cash advances against the account.

The illicit selling of fake goods or services over the phone. Many phone scams are framed as a giveaway, or free offer in exchange for sensitive information, like access to banking or credit card accounts.

Often paired with another form of fraud, bankruptcy fraud can be the concealment of assets to prevent forfeiting them, filing incomplete or false forms, filing multiple times in different locations using fake or forged documents, and bribing of court-appointed trustees.

Largely committed by organized crime groups, this form of fraud includes performing unnecessary procedures to bill an insurance company, billing for services that were never rendered, and billing every step of one procedure as if they were individual procedures.

Environmental law makes actions like the illegal disposal of waste, improper storage of hazardous materials, or failure to comply with EPA and state regulations illegal.

An act committed to defraud an insurance company is considered a white-collar crime. This could include attempting to obtain benefits or advantages that an individual is not entitled to or when an insurer denies benefits that someone is due.

One of the most common forms of fraud, mail fraud is when the USPS or private carrier is used to commit a crime of deceit. This could be to obtain money or to sell and distribute illicit goods.

These forms of fraud start with a scheme to steal or obtain financial information by using false representation or promises of goods and services in return.

Crimes committed through extortion and coercion are considered racketeering. Generally, a racketeer obtains money or goods from someone using intimidation tactics or force.

Largely connected to federal government contracting or federally-funded programs, government fraud might involve public housing, agricultural programs, corporate subsidies, and bribery.

This form of white-collar crime is the deliberate failure to pay your taxes or the underpayment of the taxes you owe. It can be underreporting of income, overreporting of deductions, or improperly claiming tax credits and exemptions.

Also called investment fraud, securities fraud involves misrepresenting the information that investors use to make financial decisions.

This is the trading of the stock or securities of a public company that is based on non-public information about the company. This is the profiteering of information based on a company’s assets.

A bribe is the giving or receiving of something of value in order to influence the actions of another person or group.

The major focus of the FBI, public corruption covers a variety of crimes, including the violation of federal law by public officials, fraud related to the procurement, contracts, and funding of federal programs, and other crimes that are related to local, state, and federal governments.

By withholding assets, funds, or goods from an employer or business partner, you are committing an act of embezzlement.

Generally sponsored by foreign entities or outside corporations, economic espionage can target the U.S. government, U.S. companies, or other establishments and institutions. Economic espionage is the unlawful obtaining of financial information.

Trade secrets are the information or assets that give a company an advantage over others in the market. The theft of these assets is when someone uses this information without consent of the business.